Table of Contents

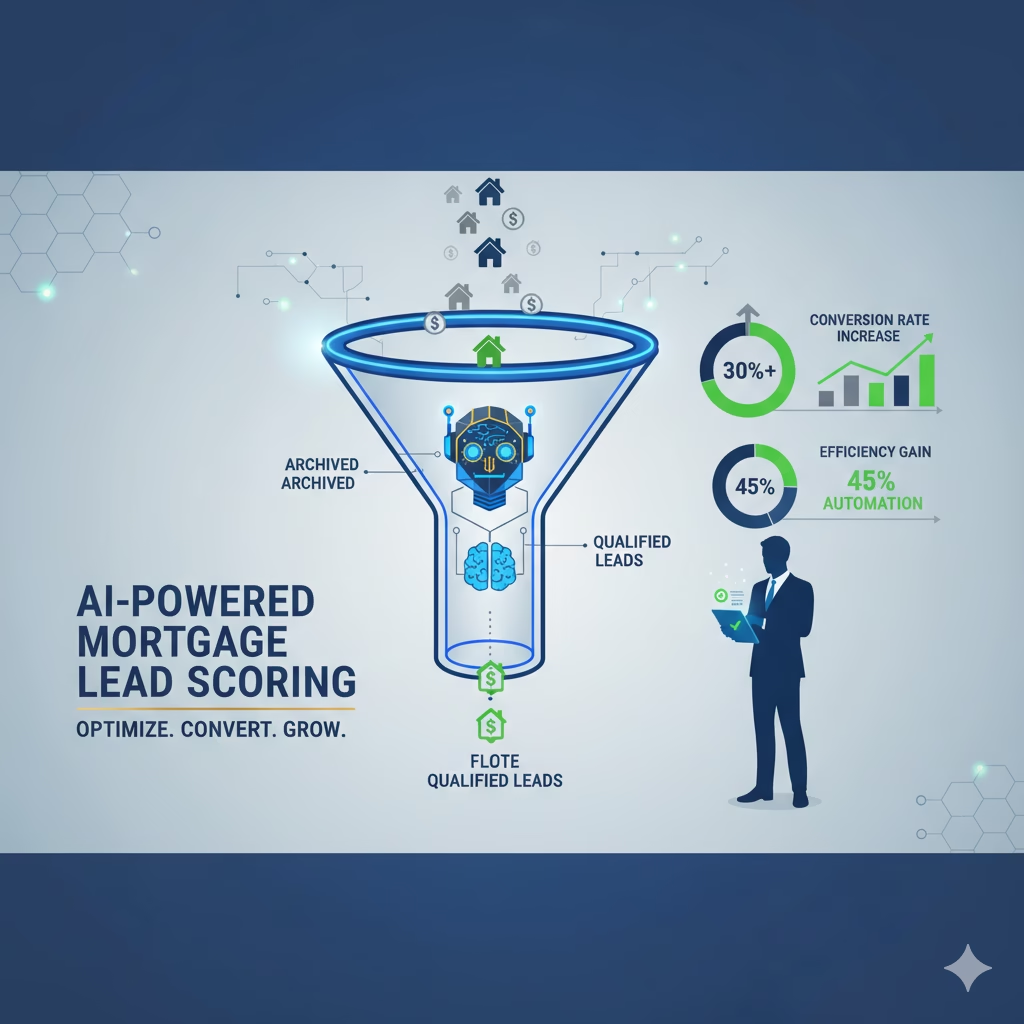

Mortgage brokers lose an estimated $47,000 annually per loan officer due to manual lead qualification processes, while 73% of potential borrowers abandon applications within the first 10 minutes when human response times exceed industry expectations. Meanwhile, automated pre-qualification systems can process initial eligibility assessments in under 2 minutes with 94% accuracy, transforming how lending professionals capture and convert leads in today’s competitive market.

The Hidden Cost Crisis in Mortgage Lead Management

The mortgage industry faces an unprecedented challenge in lead conversion efficiency. Recent Federal Reserve data shows that application abandonment rates have increased 34% since 2022, primarily due to lengthy initial qualification processes that fail to meet consumer expectations for instant digital experiences.

Traditional pre-qualification workflows create multiple friction points that directly impact revenue generation. Loan officers spend an average of 18 minutes per initial prospect call, with only 32% of these interactions resulting in qualified applications. This manual approach becomes unsustainable during peak refinancing periods when lead volumes can increase by 300% within weeks.

Current market conditions compound these challenges. Rising interest rates have made borrowers more price-sensitive and comparison-focused, reducing the window for meaningful engagement from days to hours. Regulatory requirements under HMDA and TRID add complexity to the qualification process, requiring consistent documentation and disclosure practices that manual systems struggle to maintain at scale.

The financial impact extends beyond lost opportunities. Manual lead processing increases customer acquisition costs by an average of $1,247 per funded loan, while reducing loan officer productivity by approximately 40% during high-volume periods. These inefficiencies directly affect broker competitiveness in markets where speed and accuracy determine market share.

Intelligent Pre-Qualification: Beyond Traditional Automation

Modern pre-qualification bots represent a fundamental shift from simple form-collection tools to sophisticated decision-making systems that replicate and enhance human expertise. These platforms integrate natural language processing, regulatory compliance engines, and real-time data validation to create seamless borrower experiences while generating actionable intelligence for loan officers.

The core technology combines conversational interfaces with backend systems that instantly access credit bureaus, income verification services, and property databases. Unlike static online forms, these bots adapt questioning strategies based on borrower responses, ensuring comprehensive data collection while maintaining engagement through personalized interactions.

Advanced implementations include sentiment analysis capabilities that identify borrower motivation levels, urgency indicators, and potential objections before human handoff occurs. This emotional intelligence component proves crucial for prioritizing follow-up activities and customizing approach strategies for different prospect segments.

Integration with existing CRM and loan origination systems ensures that qualified leads flow seamlessly into established workflows with complete documentation trails. The bot captures not just eligibility data, but interaction history, response times, and engagement patterns that inform subsequent human interactions and improve conversion probability.

Our AI Chatbots and Voice Agents solution demonstrates this sophisticated approach through implementations like our Strategic Loan Advisors project, where intelligent automation reduced deal-finding time by 75% while maintaining strict compliance standards. The system processes complex loan scenarios that traditional rule-based tools cannot handle, adapting to unique borrower situations in real-time.

Implementation Architecture: Building for Scale and Compliance

flowchart TD

A[Start Implementation Project] --> B[Phase 1: Discovery & Compliance Mapping]

B --> B1[Stakeholder Interviews<br/>Loan Officers, Compliance, IT]

B --> B2[Current Workflow Analysis<br/>Identify Bottlenecks]

B --> B3[Regulatory Mapping<br/>CFPB, HMDA, TRID Requirements]

B1 --> C

B2 --> C

B3 --> C

C[Phase 2: System Design & Integration Planning] --> C1[Technical Architecture<br/>Scalable, Secure Infrastructure]

C --> C2[API Specifications<br/>CRM, LOS, Third-party Services]

C --> C3[Security Protocols<br/>Encryption, Access Controls]

C1 --> D

C2 --> D

C3 --> D

D[Phase 3: Bot Development & Training] --> D1[Conversation Design<br/>Natural, Engaging Interactions]

D --> D2[ML Model Training<br/>Historical Loan Data Analysis]

D --> D3[Integration Development<br/>Connect External Systems]

D1 --> E

D2 --> E

D3 --> E

E[Phase 4: Testing & Optimization] --> E1[Functional Validation<br/>End-to-End Testing]

E --> E2[Compliance Verification<br/>Regulatory Requirements Check]

E --> E3[A/B Testing<br/>Controlled Lead Segments]

E1 --> F

E2 --> F

E3 --> F

F[Phase 5: Deployment & Monitoring] --> F1[Phased Rollout<br/>Limited Lead Volumes]

F --> F2[Performance Monitoring<br/>KPI Dashboard Tracking]

F --> F3[Staff Training<br/>Bot Intelligence Interpretation]

F1 --> G

F2 --> G

F3 --> G

G[Go-Live: Full Production<br/>90% Faster Lead Scoring Active] --> H[Continuous Optimization<br/>Based on Real-World Feedback]

style A fill:#e1f5fe

style G fill:#c8e6c9

style H fill:#c8e6c9

style B fill:#f3e5f5

style C fill:#fff3e0

style D fill:#e8f5e8

style E fill:#fff8e1

style F fill:#f1f8e9

Successful pre-qualification bot deployment requires careful integration with existing technology infrastructure while maintaining regulatory compliance and data security standards. The implementation process typically spans 8-12 weeks, with phased rollouts that minimize operational disruption while maximizing learning opportunities.

Phase 1: Discovery and Compliance Mapping

The foundation begins with comprehensive analysis of current lead management workflows, identifying bottlenecks, compliance touchpoints, and integration requirements. This phase includes stakeholder interviews with loan officers, compliance teams, and IT departments to ensure the solution addresses real operational challenges rather than theoretical improvements.

Regulatory mapping proves critical during this phase. CFPB guidelines require specific disclosures at predetermined points in the application process, while state licensing requirements may mandate certain data collection practices. The bot’s conversation flows must accommodate these requirements without creating compliance gaps or borrower confusion.

Phase 2: System Design and Integration Planning

Technical architecture development focuses on creating scalable, secure infrastructure that integrates with existing CRM, LOS, and marketing automation platforms. API specifications are finalized for third-party services including credit bureaus, income verification providers, and property valuation systems.

Security protocols receive particular attention during this phase. Sensitive financial data requires encryption at rest and in transit, with access controls that maintain audit trails for compliance purposes. The architecture must support both real-time decision-making and comprehensive data retention for regulatory examination requirements.

Phase 3: Bot Development and Training

Conversation design combines mortgage industry expertise with user experience best practices to create natural, engaging interactions that collect required information efficiently. The bot learns from actual loan officer conversations, incorporating successful qualification techniques and objection-handling strategies.

Machine learning models are trained on historical loan data to identify patterns that predict approval probability, urgency levels, and borrower preferences. This training enables the bot to make intelligent routing decisions and provide loan officers with actionable insights beyond basic qualification data.

Phase 4: Testing and Optimization

Comprehensive testing includes functional validation, compliance verification, and user experience assessment. A/B testing with controlled lead segments measures conversion improvements while identifying areas for optimization. Compliance testing ensures all disclosure requirements are met and documentation standards maintained.

Integration testing validates data flow between the bot and existing systems, confirming that qualified leads appear in CRM systems with complete information and proper categorization. This phase often reveals workflow improvements that further enhance operational efficiency.

Phase 5: Deployment and Monitoring

Phased rollout begins with limited lead volumes to validate system performance under real-world conditions. Monitoring dashboards track key performance indicators including response times, qualification accuracy, and borrower satisfaction scores. Continuous optimization based on real-world feedback ensures maximum effectiveness.

Training programs for loan officers focus on interpreting bot-provided intelligence and optimizing follow-up strategies based on qualification scores and engagement indicators. This human-AI collaboration model maximizes the benefits of both automated efficiency and personal relationship building.

ROI Analysis: Quantifying Pre-Qualification Bot Impact

The financial benefits of automated pre-qualification extend far beyond simple time savings, creating compound value through improved conversion rates, reduced acquisition costs, and enhanced loan officer productivity. Conservative estimates based on industry benchmarks and our client implementations show remarkable returns on investment.

Direct Cost Savings and Efficiency Gains

Automated systems eliminate an average of 14 minutes per lead interaction, translating to $23.40 in saved labor costs per qualified prospect based on median loan officer compensation. For brokerages processing 500 leads monthly, this represents $140,400 in annual labor savings before considering productivity improvements.

Lead qualification accuracy improvements generate additional value through reduced pipeline waste. Manual qualification processes show 27% false-positive rates, meaning loan officers spend time pursuing applications that cannot close. Automated systems with integrated credit and income verification reduce false positives to 8%, improving loan officer effectiveness and borrower experience.

Revenue Enhancement Through Improved Conversion

Speed-to-contact correlation studies show that contacting qualified leads within 5 minutes increases conversion probability by 67% compared to 30-minute response times. Automated qualification enables immediate routing of high-probability prospects to available loan officers, significantly improving connection rates and application completion.

Our case study with EC Mortgage UK demonstrated how integrated qualification systems increased lead-to-application conversion by 43% within the first quarter of implementation. The combination of instant response, accurate qualification, and intelligent routing created competitive advantages that directly translated to market share growth.

Long-term Strategic Value

Beyond immediate operational improvements, automated qualification generates valuable data insights that inform marketing strategy, product development, and market expansion decisions. Historical qualification data reveals borrower preference trends, market segment opportunities, and competitive positioning insights worth significant strategic value.

The technology foundation also enables rapid scaling during market opportunities without proportional increases in operational overhead. During refinancing booms, automated systems can handle 10x lead volume increases while maintaining service quality and compliance standards.

Implementation ROI Calculations

Based on typical mortgage brokerage operations processing 400 qualified leads monthly:

- Annual labor savings: $112,320

- Improved conversion value: $486,000 (based on 15% conversion improvement)

- Reduced acquisition costs: $124,800

- Total annual benefit: $723,120

- Implementation investment: $45,000-65,000

- ROI: 1,215% first-year return

These calculations use conservative assumptions and exclude strategic benefits like market expansion capabilities and competitive positioning improvements that further enhance long-term value.

Technical Considerations: Security, Compliance, and Integration

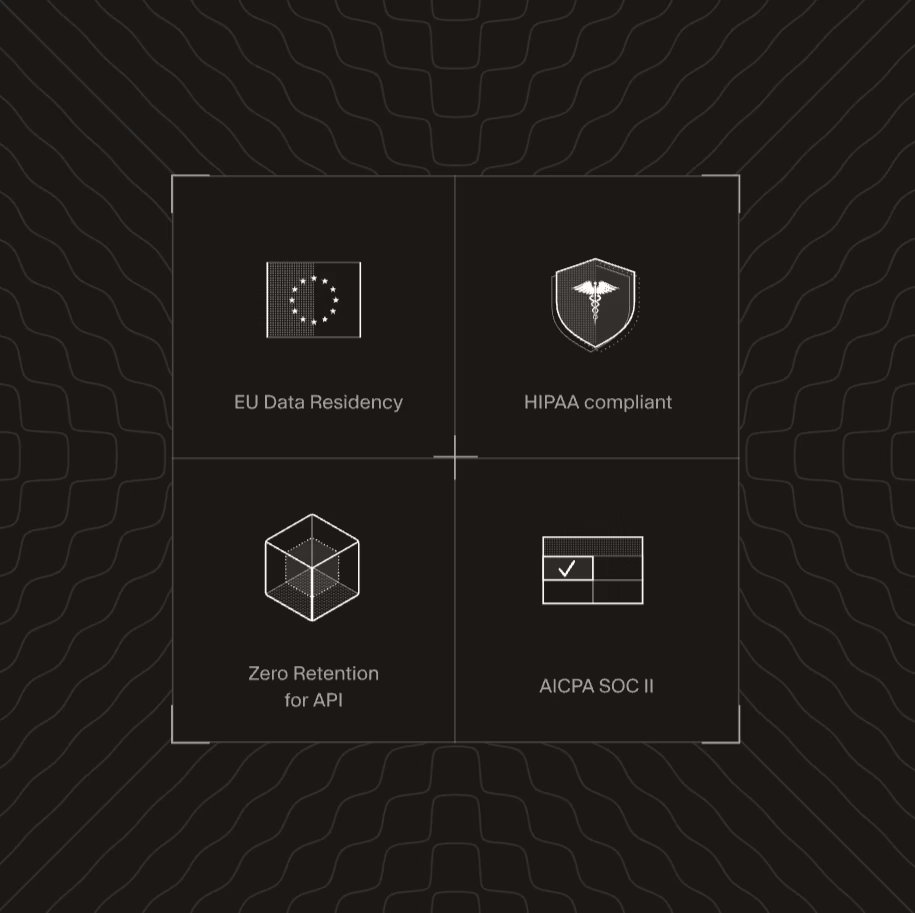

Mortgage pre-qualification bots operate in heavily regulated environments where data security and compliance requirements demand sophisticated technical architecture. Implementation success depends on addressing these requirements proactively rather than retrofitting solutions after deployment.

Regulatory Compliance Framework

CFPB regulations mandate specific disclosure timing and content requirements that must be embedded into conversation flows. The bot must deliver required disclosures at appropriate interaction points while maintaining natural conversation cadence. This requires careful choreography between engagement optimization and regulatory adherence.

HMDA reporting requirements necessitate comprehensive data capture and retention capabilities. Every interaction must be logged with sufficient detail to support regulatory examination, while personally identifiable information receives appropriate protection. Automated compliance monitoring ensures consistency across all interactions.

Data Security and Privacy Protection

Financial data transmission requires end-to-end encryption with specific protocols for data at rest and in transit. The architecture must support secure integrations with credit bureaus, verification services, and internal systems while maintaining audit trails for compliance purposes.

Access controls implement role-based permissions that limit data visibility to authorized personnel while supporting necessary workflow requirements. Multi-factor authentication and session management ensure secure access without impeding operational efficiency.

System Integration and Scalability

Modern mortgage operations depend on complex technology ecosystems including CRM platforms, loan origination systems, marketing automation tools, and third-party verification services. Pre-qualification bots must integrate seamlessly with these existing systems while supporting future technology evolution.

API-first architecture enables flexible integration patterns that accommodate different system configurations and workflow requirements. Cloud-native deployment supports automatic scaling during volume fluctuations while maintaining consistent performance levels.

Our AI Strategy & Consultation services include comprehensive technical assessment and integration planning that ensures successful implementation within existing technology environments. The approach balances immediate operational needs with long-term strategic technology goals.

Supercharge Your Lead Management Today

Automated pre-qualification represents a fundamental shift in mortgage industry operations, enabling competitive advantages through superior borrower experience and operational efficiency. The technology has matured beyond experimental implementations to proven solutions that deliver measurable business results.

Market leaders are already capturing these benefits, creating competitive gaps that will become increasingly difficult to close as borrower expectations continue evolving toward instant digital experiences. The question is not whether to implement automated qualification, but how quickly you can deploy effective solutions that drive real business results.

Our omnichannel AI CRM platform integrates pre-qualification bots with comprehensive lead management capabilities, creating seamless experiences from initial contact through loan closing. The Strategic Loan Advisors case study in our portfolio demonstrates how this integrated approach transforms entire operations, not just individual processes.

Ready to eliminate qualification bottlenecks and accelerate lead conversion? Contact our team today to schedule a strategic consultation and discover how automated pre-qualification can transform your mortgage operations. Our proven implementation methodology ensures rapid deployment with measurable results from day one.

Toronto Digital specializes in creating intelligent automation solutions that enhance human capabilities while delivering measurable business results. Our mortgage industry expertise combines deep technical knowledge with practical understanding of regulatory requirements and operational challenges. Schedule your consultation today to explore how AI-powered pre-qualification can drive your competitive advantage.